The supply chain is the backbone of any business, and it consumes a significant portion of its budget. If the SC operational cost is very high, then it would jeopardize the financial health of the company. However, if the finance department and SCM collaborate with each other, then they could manage various costs. Today, we’ll discuss finance and supply chain management; its definition, key elements in the process, integration, and benefits.

What is Finance and Supply Chain Management?

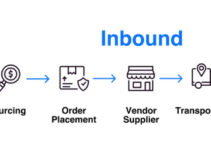

Finance and supply chain management is the method of managing monetary transactions among trading partners and facilitating procurement, selling, production, and manufacturing of products and goods. Usually, businesses and companies allocate a significant amount of resources to manage and control their physical supply chains at the cost of their finances.

When you disconnect such an interconnected connection, then it has a very bad impact on the operational capital and the very existence of the company. Well-managed finances and SCM would keep the cash flow on and the employees would receive their salaries on time.

However, it is an end-to-end process and it comprises of following;

- Procure-to-pay-cycle

- Working capital management

- Order-to-cash cycle business processes

- Ordering

- Invoicing

- Reconciliation

- Payment

The main objective of finances and SCM is to establish and maintain visibility and transparency in various SC processes. It would help you to be efficient and focus on cost-saving throughout the SC network.

Process of Finance and SCM – Key Elements

Some of the main elements in the process of finance and supply chain management are as follows;

Procure-to-Pay Cycle

As the name implies, the P2P is a form of a trade cycle that focuses on comprehending the company’s perspective like procuring raw supplies, materials, goods, products, and services. The company finds, selects, pays, and receives required items for the production of goods and services whatever customers need and require.

Working Capital Management

Every company has sufficient working capital that they employ to launch their operations and order products and goods; while they wait to clear their outstanding payments. It requires a very delicate balance; if you don’t have sufficient stock in the inventory to complete orders, then you should invest some capital in the production of goods to increase the sale. If you have got a customer’s unpaid invoices, then you won’t have the capital resources to start orders; you should main necessary supplies.

Working capital falls under the category of a company’s accounting strategy. It helps businesses and companies to maintain a balance between current assets and liabilities to make sure their financial efficiency; maintaining cash flow to meet short-term expenses like utility bills and salaries. However, if you efficiently manage the working capital, then it helps you in the following ways;

- Profitability

- Improve revenue and earning

- Limited conversion time from assets and liabilities to cash

Order-to-cash-Cycle

O2C works like P2P and it focuses on comprehending the company’s perspective like supplying raw materials, supplies, products, goods, and services. It begins when you receive quotes from the suppliers for customers; finishes after receiving the payment and reconciling the invoices. It is the main area in the accounts receivable cycle from the financial perspective. After issuing the invoices, the financial department would receive the payment in the most efficient and timely manner.

Integrating Finance and SCM – Strategies

Some of the main strategies for integrating finance and supply chain management are as follows;

Employee Training

No tool, equipment, or integration system would amplify your SC processes and financial operations if various departments and units of the company worked separately. Along with the integration system, you should offer training to the employees to collaborate with one another and employ the system rightly.

Mutual Understanding

If various departments of the company are employing different terms and KPIs to perform their functions and operations; it would amplify differences. It is significant that they should employ common terms and methods. Otherwise, their terms and data won’t make sense to each other.

Dividing SC Cost

When you link your SC operations with particular financial processes; then it allows you to comprehend the nature of SC costs.

Finding Connections

It is significant that you should discuss this with your financial and SC managers and executive, then it allows you to find the link and comprehend the method of how they approach business.

Benefits of Finance and SCM

Some of the main benefits of finance and SCM are as follows;

Adaptability

It is difficult and challenging to manage and adapt to fluctuations in supply and demand. For instance, Peloton is an American exercise equipment-producing company. The company couldn’t manage the sudden increase in demand of exercising bikes after the closure of all the fitness centers. Resultantly, customers had to wait a few months for the delivery of their order.

Right Forecasting

When you integrate SC and the financial operations of the company, then it allows you to manage a large number of variables like cash flow, risks, manufacturing cost, procurement expenses, and sales forecast. Data access helps businesses and companies to make the right and accurate forecast and maintain the company’s financial health effectively.

Cost Reduction

The financial department of the company is aware of the various expenses of the SC operations, but you fail to link a connection with them. After the availability of the SC data, then the financial executive would perform overhead analysis and they would distribute funds in the right way. It allows you to decrease the cost and manage fluctuations in demand and supply.

Conclusion: Finance and Supply Chain Management

After an in-depth study of finance and supply chain management; we have realized that the integration of finance and the SCM department is highly important. If you are learning about finance and SCM, then you should keep in mind the abovementioned elements, processes, strategies, and benefits.

References

Ahsan is an accomplished researcher and has a deep insight in worldly life affairs. He goes Live 3 days a week on various social media platforms. Other than research writing, he’s a very interesting person.